Wedges

It is possible to anticipate a wedge before it forms completely. Knowing the rally is in the wave 4/5 position warns a wedge is possible, and when a 3-leg rally unfolds, a wedge is one of the leading scenarios.

Although we can anticipate a wedge will form, it isn’t confirmed until the shape forms and other patterns are invalidated.

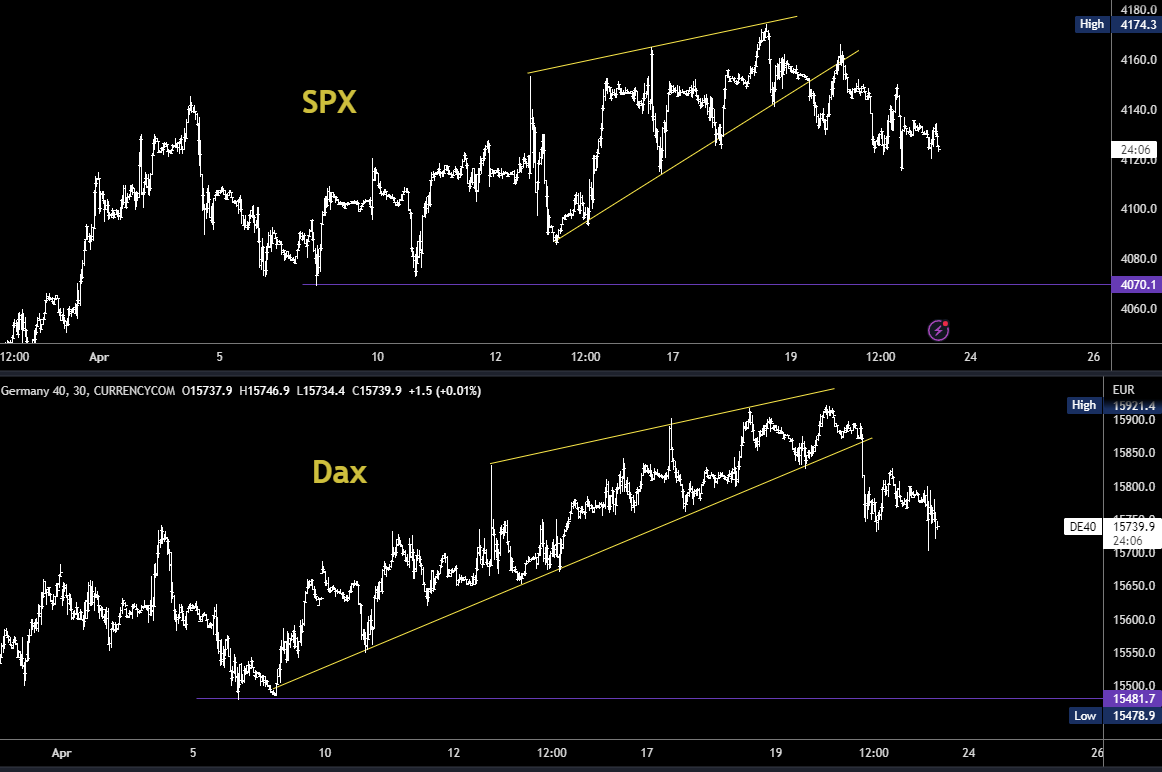

Wedges are persistent and even strong reversal patterns often fail and go on to new highs. The Dax example (see evidence) shows that both waves 2 and 4 were strong moves lower but could not follow through.

Even when a wedge breaks to the downside, unless the pattern has a long duration and multiple touches on the bottom trendline, it often morphs into a different shaped wedge. ‘Re-draws’ of the lower trendline are common, especially if the broken trendline has only 2-3 touches.

Attempting to count the individual legs is very difficult until the latter stages provide some clarity.

A convincing break of the trendline can come back for a re-test (see SPX in main chart) but doesn’t have to (see Dax).

Corrective patterns often form after the wedge is complete. Don’t be put off by apparent 3 leg declines – these are often part of the first leg lower.

The target for the wedge is the usual wave 5 = wave 1. The 1.618* extension of the wave 4 dip can also provide a guide.

Once the wedge is complete, the target is the origin of the wedge (often the bottom of wave 4).