Weak Low / High

A weak low (or high) is made when the session closes very near the low (or high) of the session. The clock has effectively been stopped mid-buy/sell cycle before any reversal. Very likely there will be further price discovery (continuation) in subsequent sessions to find a level where prices are judged unfair (leading to a reversal). The concept is the same for a weekly bar that closes at the highs /lows of the week - we can then expect continuation of the move early the next week on Monday/Tuesday.

Weak lows below broken support are good short candidates, especially if the next session opens slightly higher. We can be fairly confident the bounce will fade for new lows before any reversal.

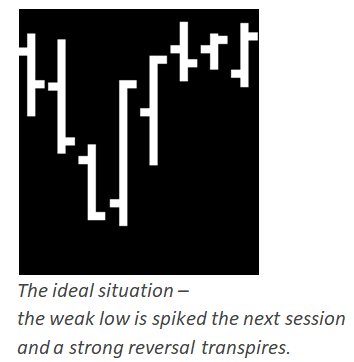

Weak lows right on a test of support are trickier - hard to buy (possible if good confluence) but not a short either. These are easier to trade if the low is spiked and reversed in the next session (see 'ideal situation' in evidence), as this 'repairs' the weak low and we can then look to buy. However, this does not always happen so neatly.

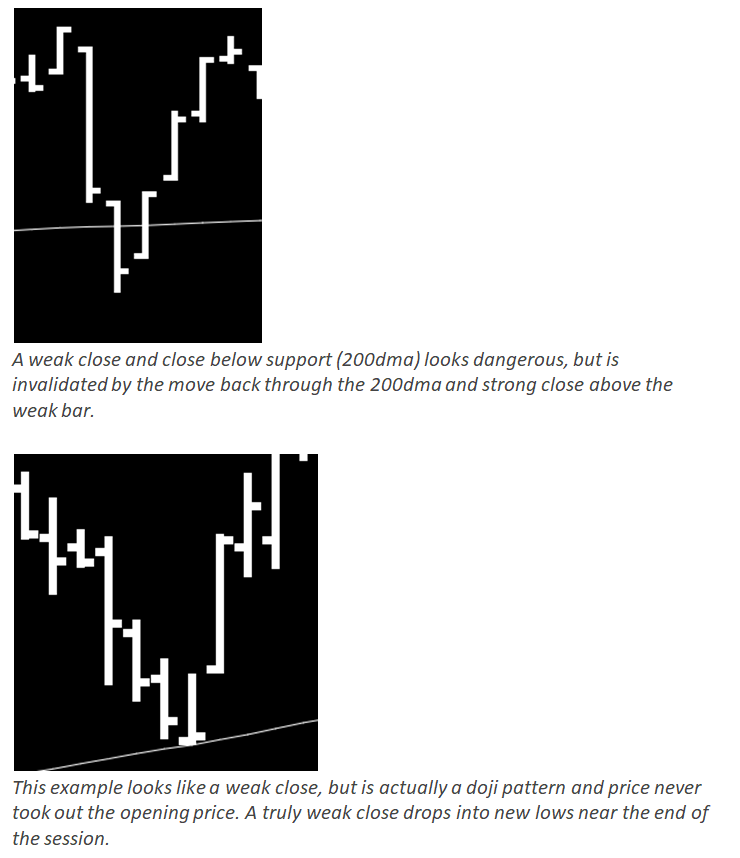

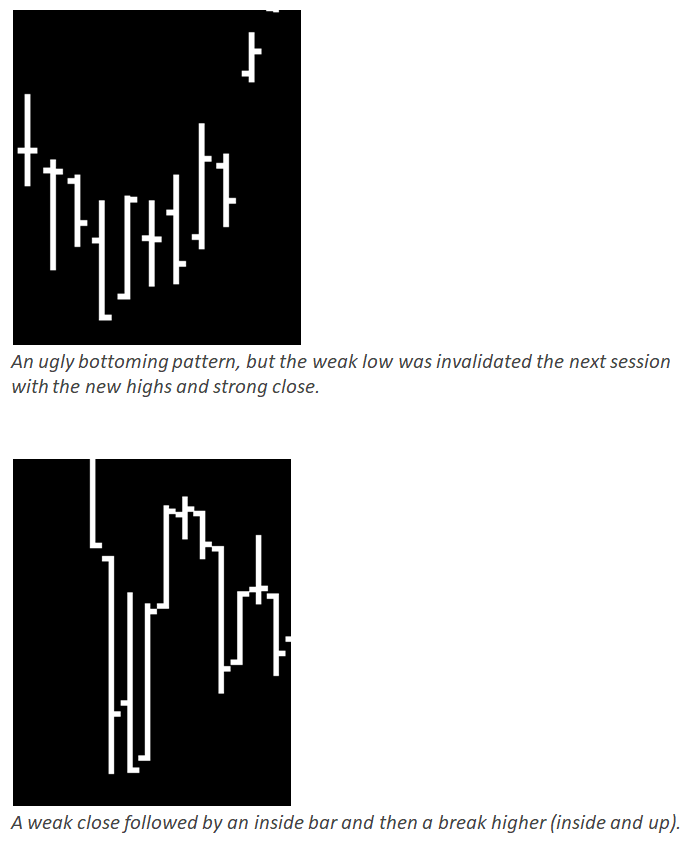

There are various considerations when a weak low does not follow through as expected and we have included examples (see variations in evidence) of some concepts to help us spot reversals after a weak low.