Pullback Trades

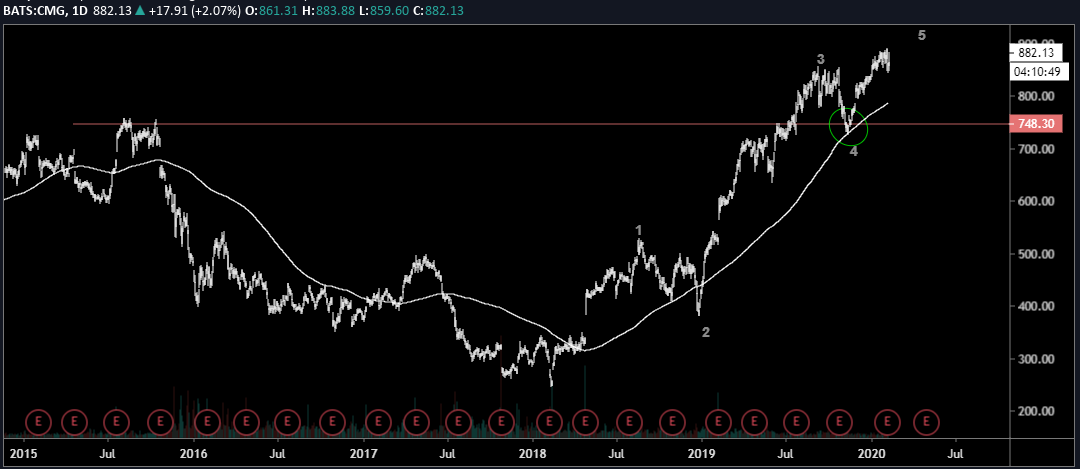

The Chipotle (CMG) chart illustrates a good pullback trade, one of our favourite types of trades. They vary greatly but share some common characteristics.

- an existing and intact trend. This is ideally at new all-time highs, but can be in all types of conditions, especially if you lower your timeframe. The important part is that we know the move will continue after a pullback. Elliott Wave helps with this and in the CMG example we could look for a wave 4 pullback to set up a wave 5 to new highs.

- There are many types of support - pivot support, channel support, MAs, pivots, Fibs, measured moves etc... It doesn't really matter what combination of support wed look for but the probabilities are much higher when we see two major supports in the same area. In the CMG example we see the 200sma and the area of the prior highs/break-out combining to provide support.

- correctional move into confluence. This is defined by Elliott Wave and is not always necessary, but probabilities are greatly improved if we can see a clearly correctional 3 leg move into support. Lower volume on the down days is also preferable.

The ideal entry is on a reversal pattern at the confluence level. In the CMG example, this came right on the 200sma with a powerful engulfing pattern followed by a day 2 gap higher.