Gap Trades

In order to trade gaps effectively we must be able to identify them and understand their characteristics; all gaps are not equal.

Traditional gap theory describes the 3 main gaps in a trend sequence. We can clearly see these gaps in the Apple chart (see evidence).

- First there is a break-away gap, usually near (but not right on) the lows. This usually comes halfway through wave 1 and breaks downtrend resistance. The break-away gap usually gives several chances to buy as it generally dips back down again in the next correction and the later for wave 2.

- The continuation / midway gap comes next. This should come in wave 3, ideally wave iii of 3 and it is usually the gap that comes on earnings or an event and breaks strong resistance. The continuation gap does not give many chances to buy but there should be at least one very high probability set-up with great risk v reward if we buy early enough. As this gap should come around half-way through the trend, we know there is plenty potential reward. We also know the gap should not fail and drop back down to fill the gap, so this defines our risk. In the AAPL example, we saw a $21 rally into the mid-point of the gap, so we should see at least another $21 rally before the next large dip. If we bought near the open, there was around $5 risk into gap fill. This gives $5 risk for >$21 reward which is better than a 4:1 RR trade.

- The exhaustion gap comes when the trend sequence is mature. It very often reverses for gap fill, although not always straight away. Be especially careful if it comes near strong resistance which breaks and then fails. If we identify an exhaustion gap we can use reversal patterns to look for shorts back to gap fill.

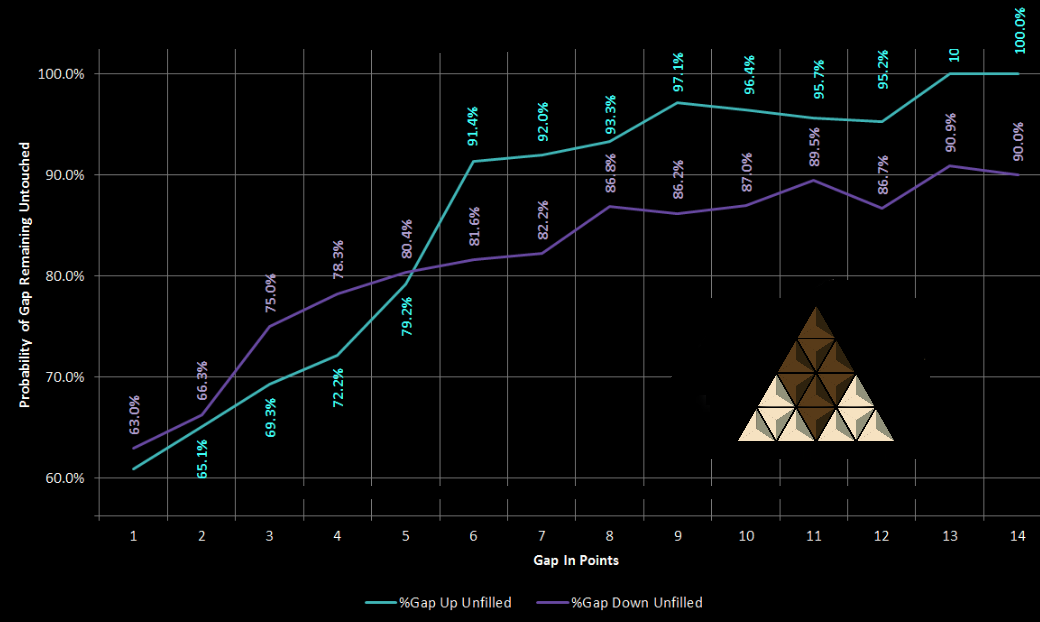

Not all gaps are as clear as the ones described. Gaps in range that do not break any support or resistance are sometimes called common gaps. These often reverse and fill the gap to the prior close. Research has shown (see evidence) that the larger the gap, the less chance it has of filling in the same session. It also shows that gaps higher have less chance of being filled than gap downs.

All gaps provide support and resistance, both at the gap window, and at gap fill. We can form a trade around these levels in confluence with other factors, but we also need a valid trade type. Support/resistance on their own are not a good enough reason to enter a trade.