Buying Major Bottoms

Picking a bottom during major downtrends/crashes is dangerous and extremely difficult. We have methods that help us in this task but every bottom is slightly different and often relies on a certain amount of 'gut' feeling.

Buying a stock after a bottom has formed is easier, and while less rewarding, we can put on larger sized trades and tighter stops.

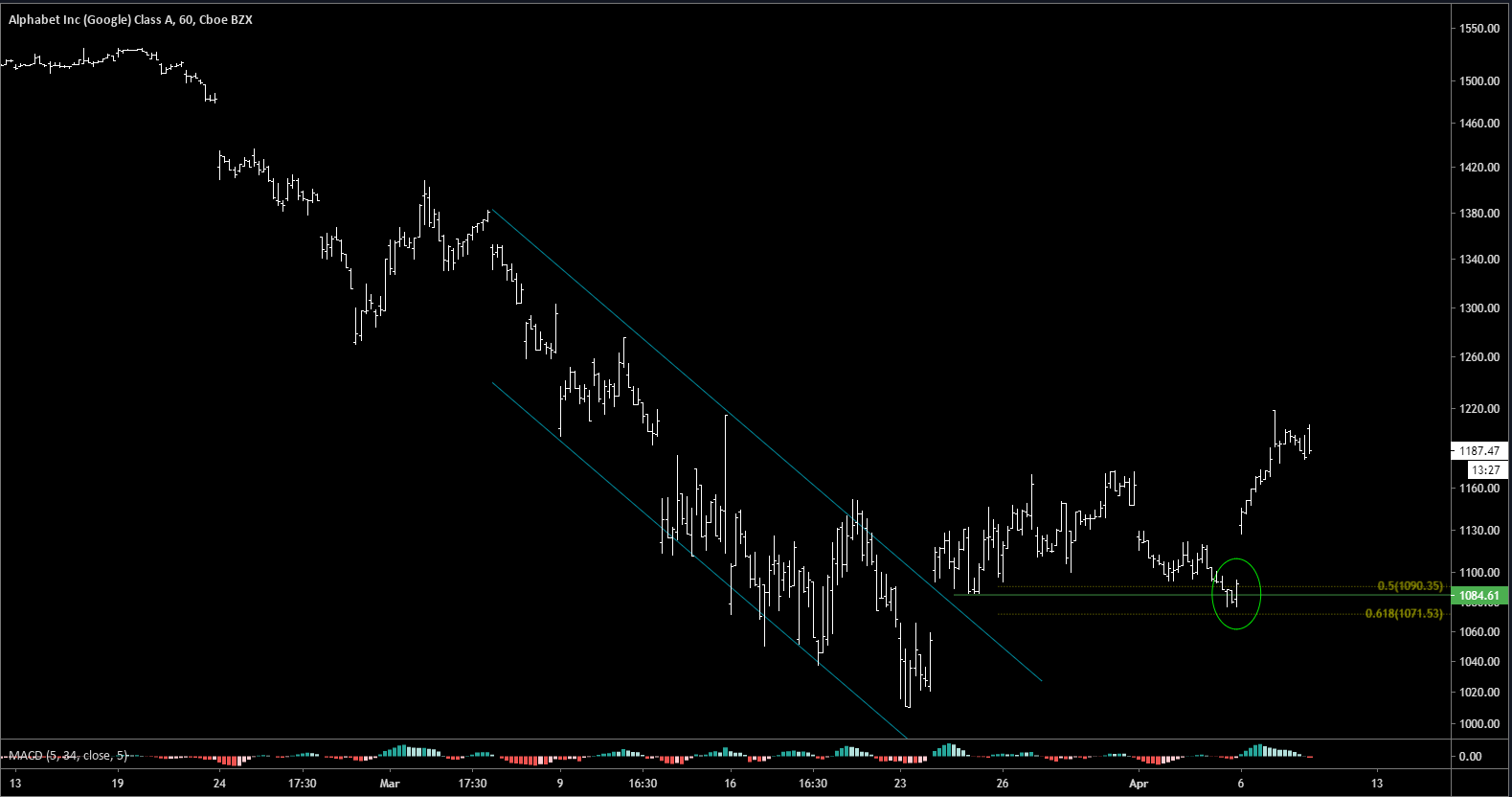

Firstly, though, how do we know a bottom has formed? We look for evidence. The GOOGL chart shows a good example. Good support at 1000 has been reached and there is a smaller timeframe trend-like rally from the low that breaks the trend channel. We don't know for sure the low is in, but since there is one trend sequence higher we can look for at least another proportional move to develop after a dip.

We then focus on buying a pullback. Sometimes the low is re-tested, especially in weak stocks, but in many ways the set-up is similar to 'buying a pullback in a trend.' That is, we look for confluence of at least two potential supports, and a correctional move into this level. In the GOOGL example we knew that the gap window and 61.8% Fib really had to hold to show any strength and it did this on a closing basis it set up a further move higher. Entry would have been 1080 with a $10-15 stop under the 61.8% retrace.